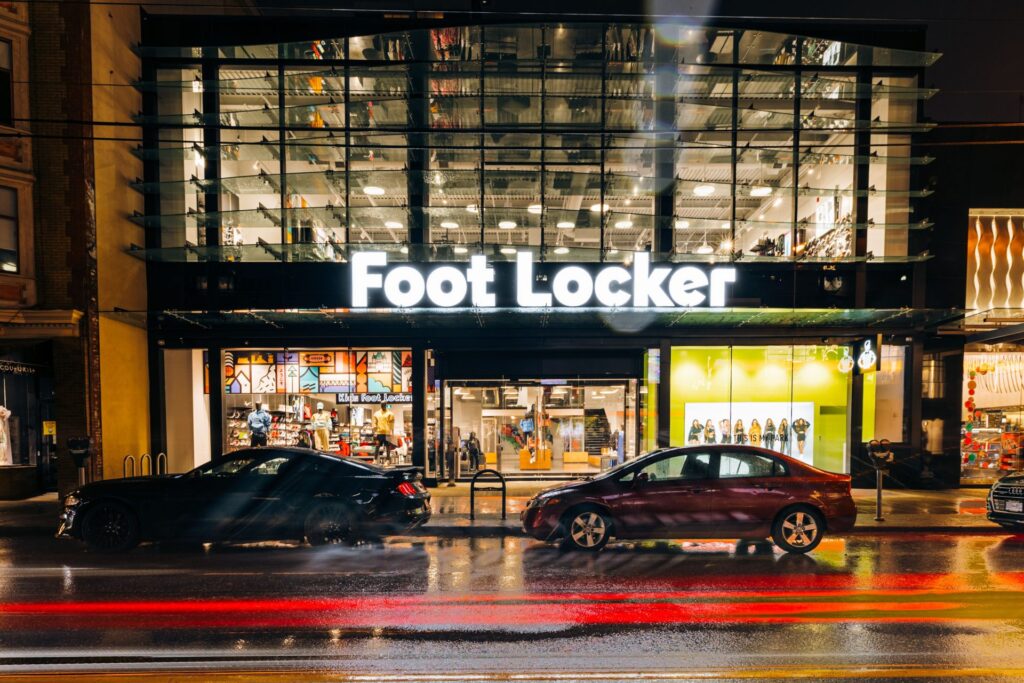

Foot Locker is embarking on a major transformation in 2025, investing heavily in store upgrades and innovative retail concepts to strengthen its position in the footwear and apparel industry. The company plans to refresh 300 existing stores and introduce 80 reimagined concept locations, signaling a commitment to enhancing the customer experience and revitalizing its brand presence.

A Bold Move Amidst Mixed Financial Results

During a March 5 earnings call, Foot Locker CEO Mary Dillon outlined the company’s aggressive turnaround strategy. Despite reporting a 5.8% year-over-year decline in total sales, comparable sales saw a modest 2.6% increase. Additionally, Foot Locker’s gross margin improved by 300 basis points, and net income from continuing operations reached $55 million—an impressive rebound from the previous year’s $389 million net loss.

These figures underscore the company’s determination to regain momentum through strategic store investments and operational refinements.

The “Reimagine” Concept and Store Refresh Program

As part of its strategic overhaul, Foot Locker is focusing on its new Reimagine concept and an extensive Store Refresh program. The company has already completed 160 store refreshes and aims to renovate 800 stores by the end of 2025.

Currently, Foot Locker has introduced eight Reimagined stores across North America, Europe, and Asia. These flagship locations have received positive feedback from customers, brand partners, and landlords, reinforcing the company’s decision to expand this initiative.

Strategic Market Exit: Closing 400 Mall Stores

In addition to expansion, Foot Locker is executing a targeted exit strategy from underperforming mall locations. The company plans to shutter approximately 400 mall-based stores to optimize its retail footprint and concentrate on high-performance areas.

With a stronger presence in top-tier malls than in 2019, Foot Locker aims to consolidate its store base, ensuring that remaining locations align with customer demand and long-term profitability.

Global Market Retraction: Exiting Select International Markets

Beyond domestic restructuring, Foot Locker is also downsizing its international operations. By mid-2025, the company will have fully exited Denmark, Norway, Sweden, and South Korea as part of its effort to concentrate on high-potential regions.

Navigating Tariff Challenges and Consumer Behavior Shifts

The ongoing uncertainty surrounding U.S.-China trade tariffs presents another challenge for Foot Locker. While a portion of its inventory originates from China, the company reassured investors that these products represent only a single-digit percentage of overall stock.

Despite macroeconomic pressures, Foot Locker remains focused on its core customers—primarily young consumers with limited discretionary budgets. The company is closely monitoring spending patterns and adjusting its pricing strategy to maintain affordability and appeal.

Looking Ahead: Foot Locker’s Road to Reinvention

With a clear roadmap for growth, Foot Locker is poised for a transformative year. By modernizing its store experience, strategically optimizing its retail footprint, and adapting to evolving consumer preferences, the company is laying the foundation for long-term success.

As 2025 unfolds, all eyes will be on Foot Locker to see how its ambitious revamp shapes the future of sneaker retail.